Pharmacists have long been established as America’s most trusted and accessible healthcare providers. According to a 2019 Drug Topics article, patients visit the pharmacy an average of 35 times a year compared to just four visits to other medical providers. The pharmacist’s direct working relationship with their patients positions them to be advocates of both safety and clinical input into medication therapy management. Due to the pharmacist’s position within the healthcare framework and their inherent skill set, the burden of cost containment related to medication management tends to fall disproportionately on independent pharmacies which often find themselves sacrificing revenue while preserving patient health.

Within the American healthcare system, patients do not have the ability to choose the framework with which pharmacies and providers are reimbursed. This framework has driven the independent pharmacy to operate on increasingly thinner margins through lower reimbursement rates and the application of DIR fees. As Star Ratings are used to evaluate and adjust Medicare plans based on quality measures, these plans take costs and pass them on to pharmacies in the form of DIR fees and clawbacks. This system was intended to promote a higher standard of care for patients while simultaneously saving money for plans, and while this approach may seem reasonable, it is not without its faults and pitfalls.

Assessments of the impact on patients found DIR fees can increase out-of-pocket costs for patients2. Patients will often find themselves paying a copay for a medication that far exceeds the cost to the pharmacy. Then, at a later date, a portion of these additional costs are deducted from future reimbursements to the pharmacy with no evidence that these savings for the pharmacy benefit manager (PBM) ever make their way back to the patient2. Furthermore, this clawback will often result in a net reimbursement that is below the acquisition cost to the pharmacy. The opaque nature of this system makes it difficult to discern the true reimbursement amount for an individual prescription or provide proof of savings being passed along to patients. Additionally, this inherent removal of patient understanding of the true cost of medication furthers imbalances in the system that allow for inflated drug pricing nationally.

DIR fees are often levied to pharmacies based on their performance on certain measures outlined by plans. These fees — or the promise of lower fees — are designed to act as an incentive for pharmacies to improve patient care. However, the real-world application of DIR fees and their effect on pharmacies raises questions of whether DIR-related metrics are being met in a clinically significant way and if PBMs incentivize the proper parties to create optimal outcomes.

For instance, one key metric affecting an increasing number of pharmacies is the statin gap therapy metric. Pharmacies are ranked against other pharmacies in a plan or against a benchmark threshold based on the percentage of patients who are taking a statin when one is clinically recommended. This metric was endorsed by the Pharmacy Quality Alliance, and an APhA-funded clinical trial was performed to evaluate the effect of pharmacist-to-prescriber intervention on statin gap therapy in patients with diabetes. This small study found that roughly 15.36% of patients within the intervention group were dispensed a statin medication when one was indicated and after pharmacist-to-prescriber intervention. This result was found to be statistically significant and a positive indicator for the ability of pharmacists to directly impact patient health.

Based on this clinical opportunity and to help pharmacies improve performance on this metric, Amplicare created the statin gap therapy report to notify staff of appropriate patients through a dedicated worklist. Once these patients are identified, pharmacists can easily contact the patient and generate a fax to send to the primary prescriber notifying them that a statin is needed. At this point, it is up to the patient’s prescriber to follow through on the recommendation as well as on the patient to take the initiative to begin the medication. These final steps potentially affect not only the gap therapy metric but also medication adherence metrics, which are significant for both pharmacy reimbursements and plan Star Ratings.

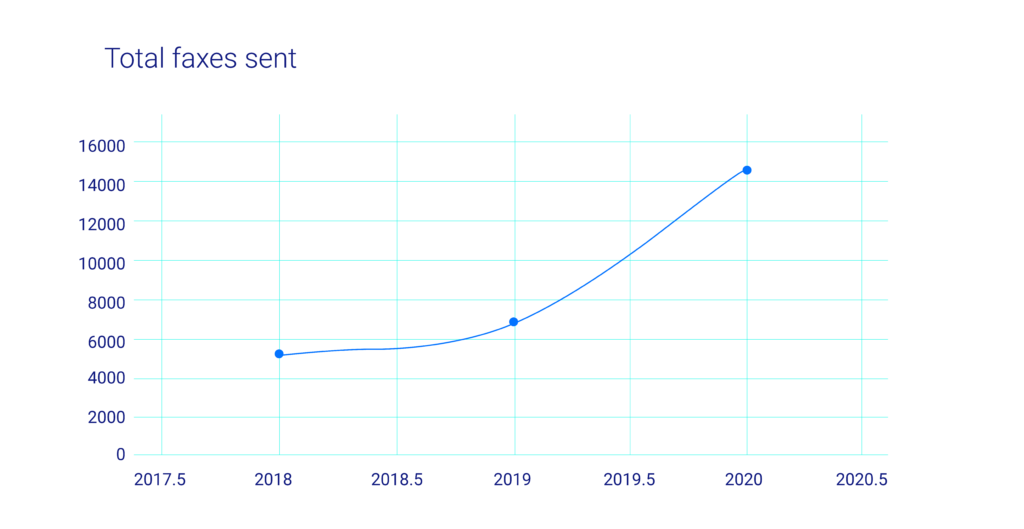

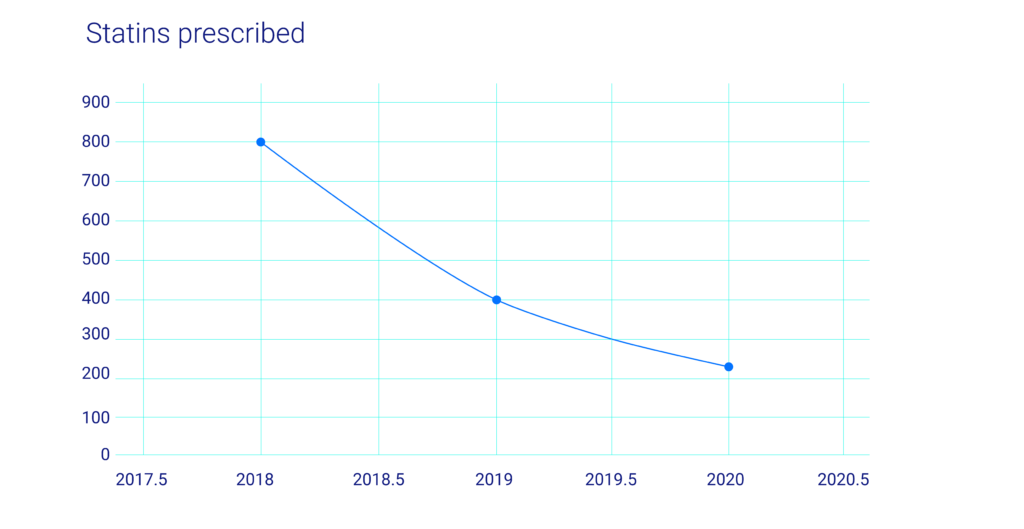

In an effort to understand the effect and efficacy of programs like the statin gap therapy metric, the Amplicare team queried its national dataset for the years 2018, 2019, and 2020 to gauge how effective and responsive prescribers are to requests from pharmacies to initiate their patients on statin medications. Year over year, the query found that Amplicare partner pharmacies submitted an increasing number of requests for statin therapy initiation: 5,065, 6,715, and 14,465 requests in each of those years, respectively (see chart 1).

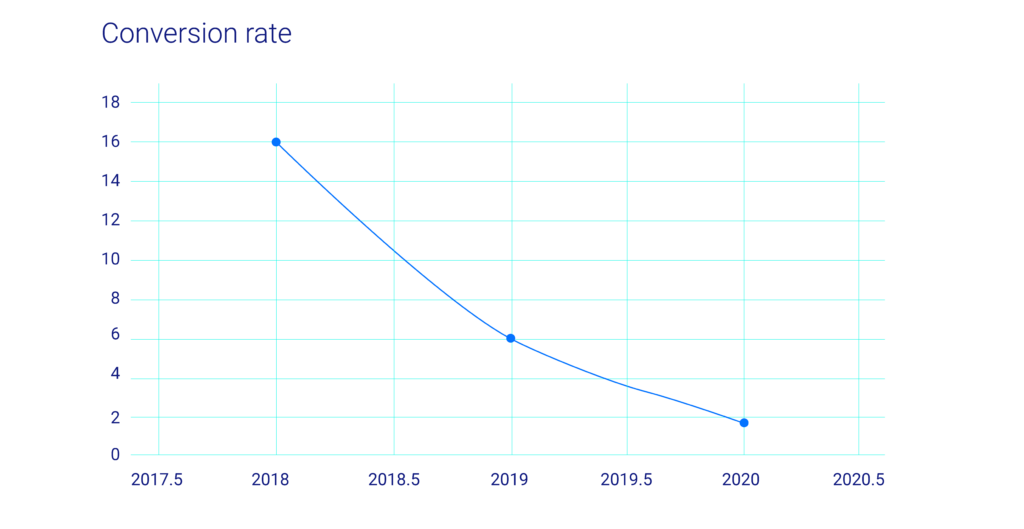

In 2018, the statin prescription rate after intervention was 16.13%. This number was similar to the APhA study published in 2017 and reinforces the idea that pharmacists possess the skillset, knowledge, and position within the healthcare hierarchy to influence prescribing practices.

However, each subsequent year after initiation of the pharmacist-to-prescriber program showed a dramatic decrease in statin prescribing despite significant increases in statin gap therapy requests. The resulting statin prescribing percentages were 6.02% for 2019 and 1.58% for 2020 (see chart 3). While the rapid spread of the COVID-19 could partially account for the steep decline in 2020’s numbers, the overall trend shows that despite efforts put in by pharmacy staff to ensure positive outcomes for their patients, the lack of provider status and a well-defined prescriptive authority limits pharmacist influence over this health metric.

Regardless, pharmacies are still penalized by PBMs on these metrics. Given this reality, a more beneficial system would see PBMs incentivize pharmacies to work more closely with patients and providers and simply provide evidence of their collaboration rather than penalizing pharmacies for variables outside of the pharmacist’s control. With the threshold of DIR impact shifting from patient ultimate action to pharmacy/prescriber collaboration, the likelihood of pharmacies making the effort to coordinate care and document it should go up dramatically. PBMs should work hand in hand with pharmacies and pharmacist organizations to ensure that pharmacists achieve provider status recognition as well as enabling a reimbursement framework that rewards the pharmacy setting for its clinical input and lowers barriers for patients to receive prompt patient-centered care. As it stands now, prescribers are free to ignore recommendations with repercussions falling to the dispensing pharmacy, and the Amplicare data suggests this seems to be the case. While it is not feasible for PBMs to shift accountability to prescribers, nor would this necessarily be the best and most prudent course of action, it is imperative for them to recognize and encourage pharmacies to continue and expand upon the work they are already currently doing. The technology exists to track and report these actions, as demonstrated by this review, and the time has long passed to start rewarding and recognizing pharmacies for the impact they have on patient health beyond that of just providing medications when prescribed. A more nuanced approach to pharmacy reimbursement through the PBM model is not only technologically feasible but necessary to moving patient health forward.

FDS Amplicare encourages further research into pharmacy reimbursement models and their effect on patient health and will look to partner with pharmacy organizations and educational institutions to stand at the forefront of software development to support the ever-evolving pharmacy landscape.

References

(1) https://www.drugtopics.com/view/pharmacists-want-more-time-patients

(2) https://www.pharmacytimes.com/news/white-paper-dir-fees-simply-explained

(3) https://www.nacds.org/pdfs/government/2019/DIR_Performance_to_Date_2019.pdf

(4) https://www.sciencedirect.com/science/article/abs/pii/S1544319117301553